Naked Shortselling

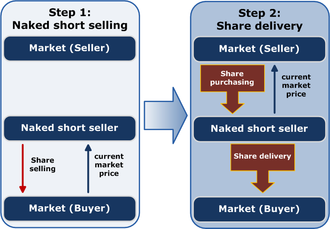

Naked Short Sales. In a “naked” short sale, the seller does not borrow or arrange to borrow the securities in time to make delivery to the buyer within the standard

What is ‘Naked Shorting’ Naked shorting is the practice of short selling shares that have not been affirmatively determined to exist. Ordinarily, traders must

A naked short sale occurs when a security is sold short without borrowing the security within a set time (for example, Porsche VW Shortselling Scandal

So what is “naked” short-selling? The same as short-selling but without borrowing the shares first, or by just getting the nod to do so if necessary.

Naked short selling has long dwelled in the grassy knoll of the equity markets, denounced by crackpots, devotees of penny stocks, and troubled companies eager to

The media demonizes naked short selling, but in most cases it occurs in a collapse, rather than causing it.

Jan 10, 2012 · A setback for America’s campaigner against naked short-selling. Overstock filed a naked-shorting case in California against a bunch of Wall Street firms.

May 18, 2010 · What is naked short selling? By Annalyn Censky, staff reporter May 19, 2010: 2:09 PM ET. NEW YORK (CNNMoney.com) — “Naked short selling” is the buzz on

Naked Short Selling information and resources. Listen and watch as Overstock.com CEO Patrick Byrne discusses Naked Shorting with the media.

Naked short selling, or naked shorting, is the practice of short-selling a tradable asset of any kind without first borrowing the security or ensuring that the

Leave a Reply

You must be logged in to post a comment.